Peter’s In-depth Analysis: Checkout What Whales and History Are Currently Signaling!

- business thoc

- Dec 16, 2025

- 4 min read

Week 50 Year 2025 Highlights – Catch Up on Everything You Missed!

YouTube | Twitter | LinkedIn | Instagram | Telegram | Website | The Inner Circle | The Moon House

Key Highlights:

YouTube Channel | What This Oversold Bitcoin Signal Could Mean

The Moon House | Are Markets Signaling the Next Expansion Phase?

The Inner Circle | Hang out with sharp minds

WEEX | Join the Free WEEX x SOC Trading Group for Exclusive Signals

House of Crypto YouTube Channel:

December 16th Video: https://youtu.be/1h5QyzLf3S0?si=TMGdIQSJyMw-WGlR

Peter explains that a rare Bitcoin oversold signal has appeared only five times since 2022 and historically led to strong recoveries within roughly 55 to 65 days. He further notes whale accumulation and declining exchange balances alongside retail capitulation, and discusses how emerging quantitative easing and improving growth conditions support a recovery phase that should benefit Bitcoin first and then altcoins later on.

December 12th Video: https://youtu.be/NipYSfA4hKo?si=ZBqG65XyqNKK0cMs

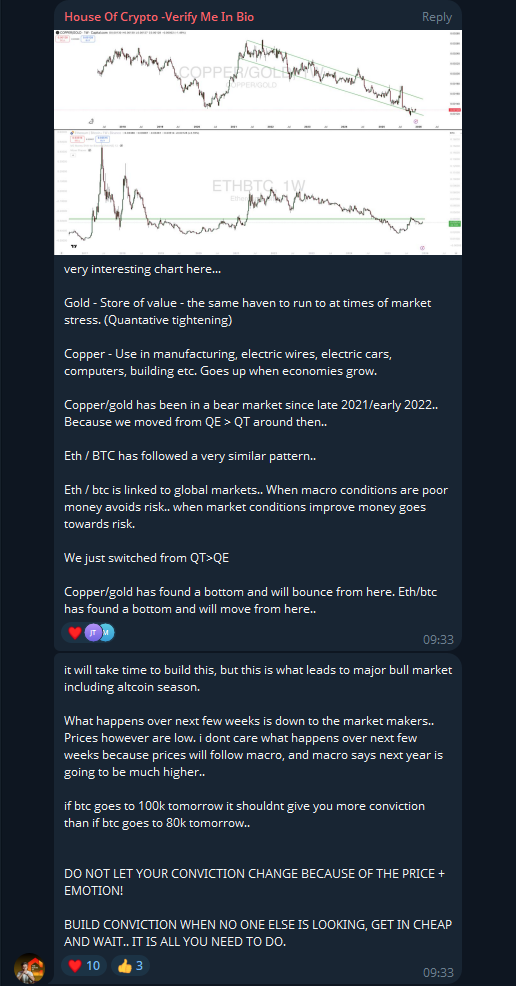

Despite significant drawdowns in altcoins, Peter points to a potential liquidity pivot, suggesting these assets are nearing cyclical lows. This optimism is based on several macro signals: copper's strong performance relative to gold, Ethereum's strengthening against Bitcoin, and a broader shift from quantitative tightening to easing. These factors collectively indicate that as risk-on conditions return to the market, altcoins are well-positioned for a recovery.

December 10th Video: https://youtu.be/vY6bDYYaUec?si=g5A4c_vC_sb2_8s7

Peter shows us that altcoins are currently at a generational low compared to Bitcoin, with the altcoin-to-Bitcoin ratio mirroring levels seen before previous altseasons. He projects that the cessation of quantitative tightening and probable financial easing will positively influence the Purchasing Managers' Index (PMI) and overall risk appetite. Consequently, he identifies larger-cap, well-funded ecosystems such as Ethereum, Solana, Sui, Aptos, and XRP as offering superior accumulation prospects in anticipation of a possible altcoin rotation next year.

Get notifications of streams by signing up to The House Of Crypto’s YouTube channel as well as The School of Crypto’s YouTube Channel. Turn on the notification bell to make sure you don’t miss out on any early discoveries on the next trend!

Here’s what our experts have been sharing over the past week:

Macro Shift Signals a Bottom for Risk Assets

Peter says that the copper to gold ratio, and the ETH to BTC chart show similar bottoming structures tied to macro liquidity cycles. Gold benefits during tightening while copper rises when growth returns, and both ratios weaken during quantitative tightening. With the shift from QT back to QE now underway, he believes these ratios mark a macro bottom and signal renewed risk appetite. ETH to BTC is expected to move higher alongside improving global conditions, even if price action remains choppy in the short term.

XRP Liquidity Expands Into the Solana Ecosystem

Our Moon House expert explains that wrapped XRP support allows XRP liquidity to flow directly into Solana DeFi applications. This unlocks new use-cases across trading, lending, and perpetuals while removing long standing usability limits around XRP. He highlights that XRP already plays a role in institutional settlement which aligns with Solana’s growing infrastructure focus. With easier value transfer between XRPL and Solana and broader asset diversity, Solana continues to strengthen its position as a liquidity hub.

Sign up to get exclusive alpha before it goes live and join our weekly live calls for Q&A, now is the perfect time to subscribe: https://whop.com/the-moon-house

Here’s what our community’s hive mind has been discussing over the past week:

Bottom Calls and Short Term Market Uncertainty

Members debate whether the market has already put in a bottom or is merely seeing a temporary bounce. Some point to momentum indicators turning lower and warn of further downside, while others note price holding support and bouncing. The discussion centers on the idea that a true bottom only becomes clear once higher highs and higher lows start forming, with continued ranging possible before direction is confirmed.

Join The Inner Circle (https://whop.com/the-house-of-crypto/) for only $19.9 a month to stay up to date with market movements, like-minded members’ discussions and unique deals that we offer on our platform.

Join the Free WEEX x SOC Trading Group for Exclusive Signals

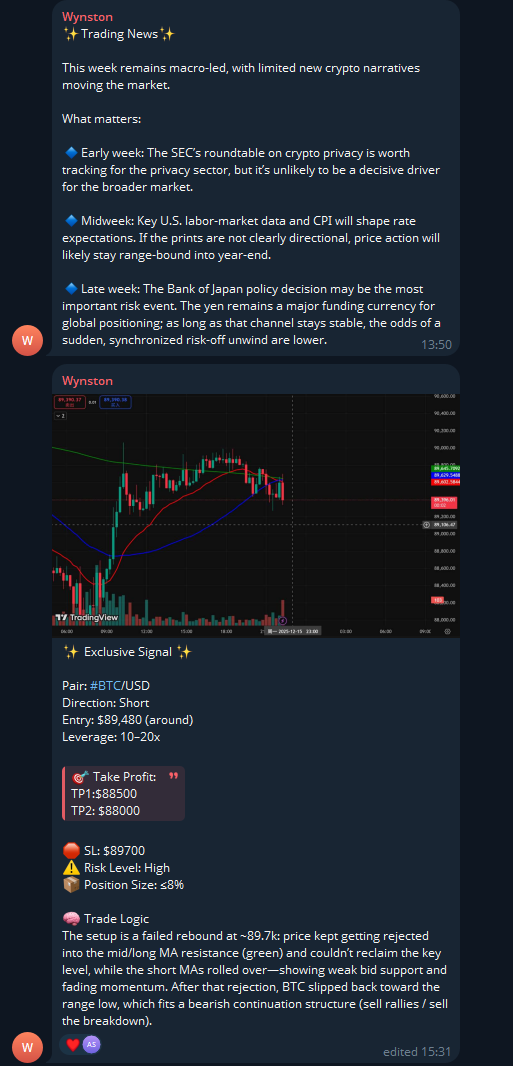

Our School of Crypto trading group continues to provide timely and actionable insights. This past week, members received a clear macro outlook covering key events from the SEC, US labor data, CPI, and the Bank of Japan, followed by a precise BTC short setup with defined entry, targets, and risk management. This is the kind of structured analysis and real time guidance you need to get ahead in your trading journey.

Join our group for free to access exclusive trading signals, macro breakdowns, and practical crypto education.

Simply click the link to join: https://THOC.short.gy/TradingGroup

Stay tuned — see you next week!

Sign up to become one of us!

🔥 Find Everything Here: https://linktr.ee/thehouseofcrypto 🔥

🌐 Website: thehouseofcrypto.io

✖️ X (Twitter): x.com/Peter_thoc

💬 Telegram: t.me/+4RGUNX-VMw04NTY1

Comments